The U.S. economy recession looms large on the horizon as mounting factors threaten to plunge the nation into economic uncertainty. Recent data highlights concerns surrounding the trade war impact on American markets, particularly in light of retaliatory tariffs imposed by countries like China, Mexico, and Canada. Coupled with a significant drop in the consumer sentiment index, these developments raise alarms about a potential stock market recession. As the Federal Reserve deliberates on interest rates, investors are left in a precarious position, trying to gauge the stability of their portfolios amidst rising risk perceptions. Understanding these dynamics is crucial for navigating the challenges posed by a potential downturn in the U.S. economy.

The impending downturn in the American economic landscape raises critical questions about its sustainability and resilience. With signs pointing to a contraction, many experts are worried about the ramifications of escalating trade tensions and a plummeting consumer confidence index. This economic malaise brings forth concerns about a possible stock market downturn, which could ultimately influence Federal Reserve decisions regarding interest rates. Furthermore, heightened risk perceptions are creating a climate of hesitation among investors and businesses alike. As these elements collide, the stability of the U.S. financial system hangs in the balance, prompting calls for a closer examination of underlying economic policies.

Understanding the U.S. Economy’s Recession Risks

Currently, the U.S. economy faces significant recession risks, fueled by a combination of factors including escalating tariffs and volatility in the stock market. As economists raise alarms, many are concerned that prolonged trade wars, particularly those influenced by tensions with countries like China and Mexico, could create an unfavorable economic environment. Observers point to a disturbing decline in the consumer sentiment index, which suggests that American consumers are increasingly apprehensive about their financial futures, potentially curtailing spending and investment.

Moreover, the warning signals from the Federal Reserve regarding interest rate adjustments add another layer of complexity to the economic landscape. Decisions to either cut rates to stimulate growth or maintain them to control inflation can create uncertainty in markets. This indecision often reflects the broader anxieties surrounding U.S. fiscal policy amidst fears of a recession. With increased market volatility and diminished consumer confidence, it is imperative that policymakers carefully navigate these turbulent waters to avert a potential economic downturn.

The Impact of Trade Wars on the U.S. Economy

Trade wars have far-reaching implications for the U.S. economy, particularly as tariffs imposed on imports lead to increased costs for American consumers and businesses alike. The retaliatory measures taken by countries such as China, Canada, and Mexico add to the uncertainty facing both investors and consumers. This interconnectedness highlights how a negative sentiment towards trade policy can suppress economic growth, as businesses may delay investment decisions due to increasing risk perception. The result is often a drag on the economy, exacerbating fears of a recession.

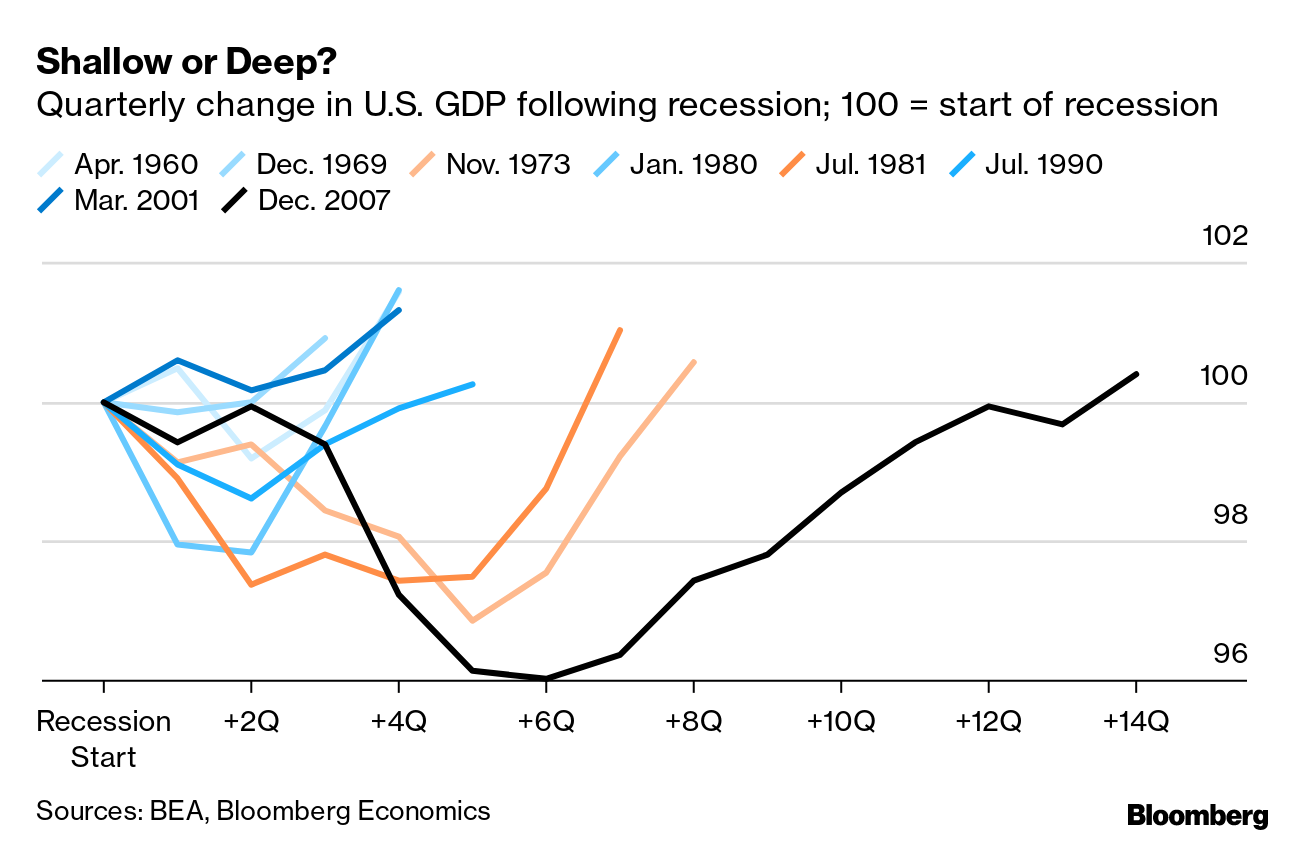

Additionally, the long-term repercussions of the trade war are seen in declining stock market performance, where investor confidence wanes in response to erratic governmental policies. As seen in previous economic indicators, a bear market can signal deeper issues within the economy, such as reduced consumer spending and slower job growth. This environment could mirror past economic downturns, raising critical questions about how the U.S. economy will recover if these trade tensions persist.

Stock Market Recession: A Growing Concern

In the current climate, a stock market recession poses a serious concern for the U.S. economy as it reflects broader economic challenges. A significant decline in stock prices can lead to reduced wealth for households and lower corporate investments, affecting hiring and spending. Analysts suggest that this downturn may be partly attributable to the uncertainties surrounding trade policies and the political landscape that have instilled fear among investors. Such instability can create a cascading effect that ultimately hampers economic growth.

Moreover, as market volatility increases, so does the risk perception amongst investors, which feeds back into the overall economic sentiment. When consumers and businesses perceive higher risks, they tend to pull back on spending and investment, further deepening the malaise in the economy. The alignment of declining stock values with a negative consumer sentiment index highlights how fragile the current economic climate is and underscores the urgent need for a comprehensive policy response.

Federal Reserve Interest Rates: A Tightrope Walk

The Federal Reserve finds itself in a challenging position as it navigates the difficult decision on interest rates. With inflationary pressures looming amid a tumultuous economic landscape, the Fed must balance the need to stimulate growth while also maintaining control over price stability. Rate cuts might temporarily alleviate some of the pressures on consumers and businesses, boosting investments; however, if inflation persists or worsens, such cuts could lead to a loss of credibility that may hinder long-term economic recovery.

Furthermore, the longstanding reliance on low interest rates as a means of fostering economic growth poses risks of its own, particularly if inflation expectations rise. The delicate equilibrium required by the Fed is compounded by external factors such as trade disputes and fiscal uncertainties. Ultimately, the Fed’s decision-making will significantly influence the direction of the U.S. economy, affecting everything from employment rates to consumer confidence.

Consumer Sentiment Index: The Pulse of Economic Health

The consumer sentiment index serves as a critical barometer of the U.S. economy’s health, reflecting how Americans feel about their finances and the overall economic prospects. A notable decline in this index corresponds closely with increased anxiety over economic stability, particularly given the current trade war dynamics and rising inflationary concerns. When consumer confidence wanes, it can lead to reduced spending, which is a significant component of economic activity. Thus, monitoring this index is vital for understanding potential downturns.

As the consumer sentiment index drops to its lowest level since late 2022, the implications for the broader economy become increasingly dire. Businesses may experience slow sales as caution prevails over spending, resulting in stagnated growth. The government and policymakers must respond with strategies to restore consumer confidence, as its recovery could serve as a catalyst for economic revitalization amidst the fears of an impending recession.

Forecasting Economic Growth Amid Challenges

Despite the current challenges faced by the U.S. economy, there remains a potential for recovery and growth. Addressing trade policy, stabilizing the stock market, and fostering a more favorable business environment are crucial steps towards achieving sustainable economic performance. Policymakers must navigate the complexities of tariffs and international relations to promote a more competitive U.S. market, which can alleviate some of the burdens currently weighing on consumers and businesses.

Moreover, proactive measures to enhance confidence in the economy can mitigate risks of recession. This involves not only addressing immediate concerns related to trade and interest rates but also ensuring that fiscal policies support long-term growth. By investing in infrastructure, education, and technology, the U.S. economy can develop a more robust foundation that withstands external shocks and fosters resilience, ensuring sustained economic progress.

The Role of Government Fiscal Policies

Government fiscal policies play a pivotal role in shaping economic conditions and can either exacerbate or alleviate recessionary pressures. Current fiscal challenges, including budget deficits and potential government shutdowns, add layers of complexity to the economic outlook. As the administration grapples with balancing necessary spending against rising debt levels, investors and consumers alike remain skeptical about the U.S. economic trajectory.

Moreover, fiscal discipline and thoughtful budget management are essential to restoring confidence and stability in the markets. By instituting clear guidelines for spending, the government can help counteract the negative perceptions driven by uncertainty. This commitment to sound fiscal governance can foster an environment where businesses feel secure enough to invest and grow, ultimately supporting a more stable economic landscape.

Understanding the Implications of Tariffs

Tariffs have far-reaching implications that extend beyond immediate economic concerns, affecting industries, consumers, and international relations. While proponents argue that tariffs can protect domestic industries, the reality often reveals a more complicated picture, as they also can lead to increased prices for consumers. This economic friction is evident in the recent market decline, where retaliatory tariffs imposed by other nations contributed to a downward spiral in stock performance, raising fears surrounding a recession.

The complexities of implementing tariffs raise questions about their effectiveness in achieving desired economic outcomes. Analyzing historical precedents reveals that protectionist measures may shield industries in the short term but could ultimately stifle innovation and competitiveness. Policymakers must consider these broader implications when contemplating tariffs, ensuring that approaches align with long-term economic growth goals and do not merely serve immediate political objectives.

Navigating Future Economic Uncertainties

Navigating the future economic landscape will require a delicate balance between addressing immediate challenges and laying the groundwork for sustainable growth. Uncertainties surrounding trade tensions, interest rates, and fiscal policy necessitate a proactive approach that anticipates potential downturns and implements measures to bolster resilience. Establishing clear communication with investors and consumers about policy directions can help mitigate fears and create a more conducive environment for growth.

Moreover, as the U.S. economy faces various pressures, engaging stakeholders from different sectors becomes vital. Collaborative efforts among government agencies, business leaders, and economic experts can yield innovative solutions that address structural issues within the economy. Such collective action can help restore confidence and promote a favorable environment conducive to investment, ultimately steering the economy away from recessionary territories.

Frequently Asked Questions

How will the U.S. economy recession impact consumer sentiment and spending?

The U.S. economy recession typically leads to a decline in consumer sentiment, as individuals become more cautious about spending. Factors such as increased uncertainty, reduced job security, and rising prices contribute to this mentality, ultimately impacting economic growth.

What role does the Federal Reserve interest rates play during a U.S. economy recession?

During a U.S. economy recession, the Federal Reserve may lower interest rates to stimulate economic activity. Lower rates reduce borrowing costs, encouraging spending and investment. However, there is also a risk of inflation if rates are kept too low for too long.

How might a trade war affect the U.S. economy during a recession?

A trade war can exacerbate a U.S. economy recession by increasing tariffs, which raises costs for consumers and businesses. This leads to decreased spending, lower investment, and ultimately a contraction of economic growth, further deepening recessionary conditions.

What indicators suggest a potential stock market recession and its link to the U.S. economy?

Indicators such as significant drops in stock prices, declining investor confidence, and poor earnings reports can signal a stock market recession. These factors often reflect underlying weaknesses in the U.S. economy, such as reduced consumer spending or business investment.

What is the consumer sentiment index and how does it relate to the U.S. economy recession?

The consumer sentiment index measures how optimistic or pessimistic consumers are regarding the economy’s performance. A declining index often indicates a lack of confidence in the U.S. economy, which can foreshadow a recession if consumer spending declines significantly.

Can job losses trigger a U.S. economy recession?

Yes, substantial job losses can trigger a U.S. economy recession. As employment falls, consumer spending diminishes, leading to decreased business revenues and further layoffs, creating a negative feedback loop that can deepen recessionary conditions.

What are the potential long-term effects of a U.S. economy recession on market stability?

A U.S. economy recession can lead to long-term market instability through prolonged uncertainty, reduced investments, and slow recovery rates. Businesses may become hesitant to spend or expand, and consumer confidence could take years to fully restore.

| Key Point | Details |

|---|---|

| U.S. Economy Condition | Reactive to trade wars and tariffs, leading to potential recession worries. |

| Recent Market Performance | Significant losses in U.S. markets due to retaliatory tariffs from China, Mexico, and Canada. |

| Investor Sentiment | Falling consumer sentiment index at its lowest since November 2022. |

| Tariff Impacts | Economists argue against tariffs, seeing them as detrimental to economic confidence and growth. |

| Federal Reserve Stance | Balancing interest rates to support employment vs controlling inflation. |

| Future Predictions | Economists believe a recession may be imminent due to various adverse factors. |

Summary

The U.S. economy recession is a topic of growing concern as market conditions appear to worsen, accentuated by escalating trade tensions and a decline in consumer sentiment. With fears of a prolonged trade war, experts warn that without effective policies to stabilize the economy, the likelihood of entering a recession increases. Investors should remain vigilant as uncertainty continues to grip the markets, impacting employment and consumer spending.