Corporate tax cuts have become a focal point of significant debate in recent years, particularly following the enactment of the Tax Cuts and Jobs Act (TCJA) in 2017. This legislation dramatically reduced corporate tax rates from 35% to 21%, aiming to stimulate economic growth by encouraging business investment and innovation. However, a recent study led by economist Gabriel Chodorow-Reich sheds light on the mixed outcomes of these corporate tax cuts, revealing modest increases in wages and business investments — yet falling short of compensating for the substantial loss in tax revenue. As policymakers prepare for crucial decisions surrounding US corporate tax policy in 2025, the insights from Chodorow-Reich’s analysis are pivotal to understanding the broader impact of tax cuts on the economy. With competing narratives from both sides of the aisle, the discussion surrounding corporate tax cuts is not just about numbers, but about the implications for everyday Americans and the economy as a whole.

The discussion surrounding reductions in business taxation is gaining traction as the expiration of key provisions from the Tax Cuts and Jobs Act approaches. Proponents argue that lowering corporate tax burdens can invigorate the economy by promoting capital investment and productivity growth. Conversely, critics raise concerns about the potential erosion of federal revenue and its implications for essential public services. The scholarly work of Gabriel Chodorow-Reich offers valuable insight into the effects of these tax shifts, emphasizing the nuanced outcomes impacting both wages and investment levels. As the nation prepares for a tax policy review, understanding the complexities of corporate tax reform becomes increasingly vital.

The 2017 Tax Cuts and Jobs Act: An Overview

The Tax Cuts and Jobs Act (TCJA), enacted in December 2017, marked a significant shift in U.S. tax policy, particularly regarding corporate tax rates. This comprehensive tax reform aimed to stimulate economic growth by lowering the corporate tax rate from 35% to 21%. Advocates believed that by cutting corporate taxes, businesses would have more capital to reinvest, leading to increased wages and job creation. The law also introduced various provisions, such as immediate expensing of capital investments, intended to boost domestic production and innovation, making the U.S. corporate environment more competitive globally.

However, the TCJA has been subject to substantial scrutiny and debate, particularly as its key provisions approach expiration. Critics argue that while the tax cuts may have provided short-term benefits, the long-term implications are concerning. For instance, the reduction in corporate tax revenues has been juxtaposed against the actual increases in investments and wages, raising questions about whether the cuts have been effective in stimulating sustainable economic growth. As we approach 2025, discussions surrounding the renewal or alteration of these tax provisions are expected to feature prominently in political discourse.

Frequently Asked Questions

What are the key effects of corporate tax cuts under the Tax Cuts and Jobs Act?

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly reduced corporate tax rates from 35% to 21%. According to recent research by Gabriel Chodorow-Reich, these corporate tax cuts led to an approximate 11% increase in business investment and modest wage growth, although not as substantial as initially projected. The study highlights that while the law encouraged some capital expenditures, it also resulted in a significant drop in federal corporate tax revenue.

How did the corporate tax cuts impact business investment according to the Gabriel Chodorow-Reich study?

The Gabriel Chodorow-Reich study found that the corporate tax cuts enacted through the Tax Cuts and Jobs Act led to a notable 11% increase in business investments. The research showed that while traditional rate cuts provided some benefits, provisions that allowed for immediate expensing of investments had a more pronounced effect on driving investment growth.

What was the anticipated outcome of the corporate tax cuts on wages as per the TCJA?

The Tax Cuts and Jobs Act was expected to significantly boost wages, with projections suggesting an increase of $4,000 to $9,000 per full-time employee. However, the analysis by Gabriel Chodorow-Reich and his colleagues estimated that the actual increase in wages was closer to $750 annually, indicating that the real impact of corporate tax cuts on wage growth was less significant than proponents had claimed.

What are the implications of corporate tax policy changes for federal revenue?

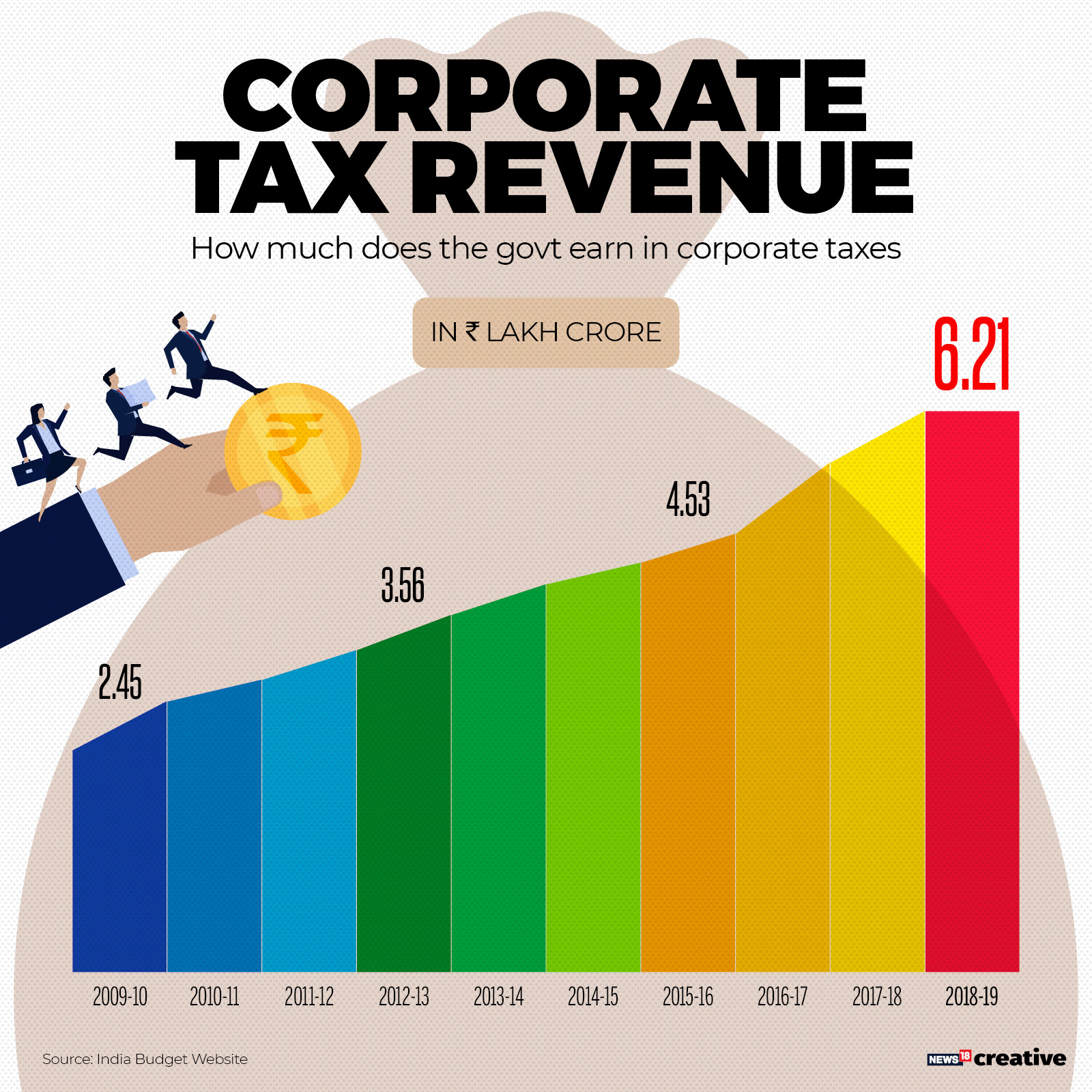

The corporate tax cuts from the Tax Cuts and Jobs Act initially led to a 40% decline in corporate tax revenue. However, beginning in 2020, revenues started to recover as business profits surged. This unexpected growth in corporate profits highlights the complex dynamics between corporate tax rates and tax revenue.

Will corporate tax rates increase again after the TCJA provisions expire?

As key provisions of the Tax Cuts and Jobs Act set to expire at the end of 2025, discussions about increasing corporate tax rates have intensified. Prominent voices like Kamala Harris advocate for higher rates to fund other initiatives, while others argue for maintaining or reducing rates to foster growth. The future of corporate tax rates will depend on upcoming legislative decisions and negotiations.

| Key Points |

|---|

| Congress is planning for a tax battle in 2025 as key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire, which include debates on corporate tax cuts. |

| A recent analysis of the TCJA highlights modest increases in wages and business investments, but overall corporate tax revenue dropped significantly. |

| Economists are divided on the effectiveness of the TCJA. Some argue it leads to higher investment, while others emphasize the minimal impact on wages. |

| The TCJA reduced the corporate tax rate from 35% to 21%, projected to decrease federal revenues by $100-$150 billion annually within a decade. |

| Chodorow-Reich suggests restoring expensing provisions and raising statutory corporate rates could be a beneficial approach in future reforms. |

| Corporate tax revenues initially fell by 40% post-TCJA but started to recover in 2020 as businesses adapted and profits surged. |

| The analysis emphasizes that recent corporate tax policies can significantly impact investment but yield a smaller effect on wages than previously anticipated. |

Summary

Corporate tax cuts have been a hotly debated topic, especially with the upcoming expiration of the key provisions of the 2017 Tax Cuts and Jobs Act (TCJA). As we approach 2025, lawmakers must weigh the benefits of these cuts against their impact on revenue and the economy. The mixed results from recent studies indicate that while corporate tax cuts can encourage some level of investment, the anticipated increases in wages may not be as significant as hoped. This ongoing analysis of corporate tax implications is critical as politicians on both sides prepare for what promises to be a contentious tax battle.